Nevada Lithium Applauds Boron’s Addition to 2025 US Critical Minerals List

VANCOUVER, British Columbia, Nov. 11, 2025 (GLOBE NEWSWIRE) — Nevada Lithium Resources Inc. (TSXV: NVLH; OTCQB: NVLHF; FSE: 87K) (“Nevada Lithium” or the “Company”) is pleased to announce that it has learned that boron has joined lithium on the Final 2025 List of Critical Minerals maintained by the United States Department of the Interior (the “U.S. Critical Minerals List”), announced by the United States Department of the Interior on November 7, 2025. The Company’s 100% owned Bonnie Claire Lithium Project (the “Project”) hosts the largest boron resource in the state of Nevada.

As a result of this designation, Bonnie Claire is now projected to generate revenue from two elements on the List, lithium and boron, deemed to be of the highest importance to the US government. The Company also recently announced the presence of two more critical minerals, cesium and rubidium, in its mineralization, and indicated the potential for recovery of those minerals.

Boron’s inclusion on the 2025 U.S. Critical Minerals List also increases the potential for Nevada Lithium to engage with U.S. government funding programs. These programs support the development, processing, and refining of critical minerals, and are administered by the U.S. Department of War, The Office of Strategic Capital and the U.S. International Development Finance Corporation.

The One Big Beautiful Bill Act of 2025 (the “OBB”) authorized $5 billion for investments in critical minerals supply chains made pursuant to the Industrial Base Fund and up to $100 billion in principal amounts of direct loans and guaranteed loans for critical minerals and related industries and projects. Provisions in the OBB also allow for increased and accelerated depreciation of US based manufacturing facilities that the Company may benefit from, and is currently evaluating.

Nevada Lithium’s CEO, Stephen Rentschler, comments:

“Advocates for boron’s inclusion onto the U.S. Critical Minerals List have long recognized the importance of boron to various segments of US industry and defense. The formal inclusion of boron onto the updated 2025 U.S. Critical Minerals List reflects the increasing realization of US dependence on many raw materials that Nevada Lithium’s 100% owned Bonnie Claire Project could provide.

In addition to the production of over 62,000 tonnes of lithium carbonate over a 61 year mine life, Bonnie Claire’s August 2025 Preliminary Economic Assessment (“PEA”) projects an annual production rate of over 129,000 tonnes of boron in the form of boric acid, a precursor to boron carbide. Boron carbide plays an important role in advanced armor applications due to its hardening ability.

According to the results of the Bonnie Claire’s August 2025 PEA, the contribution from boric acid production is expected to reduce Bonnie Claire’s production costs by $1,973 per tonne of lithium carbonate. The $950/tonne long term boric acid price assumption used for this modeling was derived before the addition of boron to the 2025 U.S. Critical Minerals List.

Bonnie Claire’s lithium resource is already one of the highest grade, and largest in Nevada. In addition to lithium and boron, we are excited about the potential to recover more critical minerals from the List. This potential is a result of the coexistence of high-grade lithium, boron, cesium and rubidium in the high-grade Lower Zone at Bonnie Claire. This Lower Zone remains open in three directions for significant distance.

The Company is currently working with various entities to determine the recoverability of cesium and rubidium. Recovery of these minerals could contribute to increased profitability for the Project, as well as the establishment of new supply chains of interest to the US government.”

Boron Mineral Resource Estimate

The Mineral Resource Estimate comprises separate estimates of the Lower Zone, characterised by high grade lithium and boron and the Upper Zone, characterised by moderate-grade lithium and boron.

The current boron Mineral Resource Estimate has an effective date of March 31, 2025 and contains 85.654 million tonnes of boric acid equivalent (Inferred) and 16.973 boric acid equivalent (Indicated) in the high-grade Lower Zone, which remains open for expansion.

Lower Zone

The Lower Zone forms a shallowly-dipping sheet approximately 300-350m thick, intersected between approximately 500-850m depth, and remains open to the NW, NE and SE. The mineral resource estimate for the Lower Zone is presented in Table 1. The base-case mineral resource is reported at an 1,800ppm lithium cut-off, based on a reasonable prospect of economic extraction using the underground HBHM method, assuming a 60% HBHM Recovery.

| Table 1: Bonnie Claire Lower Zone Boron Mineral Resource Estimate |

||||

| With 60% Borehole Mining Recovery |

||||

| Class | Boron | |||

| Mass (Million Tonnes | B Grade (ppm) | B (million Tonnes) | Boric Acid Eq. (Million Tonnes) | |

| Indicated | 275.85 | 10,758 | 2.968 | 16.973 |

| Inferred | 1,561.06 | 9,593 | 14.976 | 85.654 |

1. The effective date of the Mineral Resource Estimate is March 31, 2025.

2. The Qualified Person for the estimate is Terre Lane of GRE.

3. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

4. Mineral Resources are reported at a 1,800 ppm Li cutoff, an assumed lithium carbonate (Li2CO3) price of $20,000/tonne, 5.323 tonnes of Li2CO3 per tonne Li.

5. The Boric Acid Equivalent calculation assumes 5.719452 tonnes of boric acid per tonne of boron.

6. Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Upper Zone

The Upper Zone forms a sub-horizontal sheet extending from surface to about 425ft (130m) depth, and remains open to the NW, NE and SE. The mineral resource estimate for Upper Zone is presented in Table 2. The base-case resource is reported at a 900ppm lithium cut-off, based on conventional open-pit methods.

| Table 2: Bonnie Claire Upper Zone Mineral Resource Estimate | ||||

| Within a Constraining Pit Shell | ||||

| Class | Boron | |||

| Mass (Million Tonnes) | B Grade (ppm) | B (Million Tonnes) | Boric Acid Eq. (Million Tonnes | |

| Indicated | 188.08 | 2,140 | 0.403 | 2.302 |

| Inferred | 449.88 | 1,911 | 0.860 | 4.918 |

1. The effective date of the Mineral Resource Estimate is March 31, 2025.

2. The Qualified Person for the estimate is Terre Lane of GRE.

3. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

4. Mineral Resources are reported at a 900 ppm Li cutoff, an assumed lithium carbonate (Li2CO3) price of $20,000/tonne, 5.323 tonnes of Li2CO3 per tonne Li, 75% recovery, a slope angle of 18 degrees, no royalty, processing and G&A cost of $26.52/tonne, mining cost of $3.52/tonne, and selling costs of $100/tonne Li2CO3.

5. The boric acid equivalent calculation assumes 5.719452 tonnes of boric acid per tonne of boron.

6. Numbers in the table have been rounded to reflect the accuracy of the estimate and may not sum due to rounding.

Other Critical minerals

The potential for recovery of other materials on the 2025 U.S. Critical Minerals List, such as cesium and rubidium was released to the markets in the Company’s news release dated September 17, 2025. In that news release, the Company highlighted the coexistence of elevated levels of cesium and rubidium with the high-grade lithium and boron mineralization of its Lower Zone.

Composites for cesium and rubidium are outlined below in Table 3 and Table 4.

| Table 3 Cesium Composites | ||||||

| From (ft) | To (ft) | Interval (ft) | Cs (ppm) | Li (ppm) | B (ppm) | |

| BC-2301C | 2040 | 2400 | 360 | 208.7 | 3,913.9 | 15,541.1 |

| BC-2303C | 2160 | 2500 | 340 | 212.7 | 4,743.5 | 16,849.4 |

| BC-2401C | 2347 | 2665.5 | 318.5 | 248.0 | 5,382.3 | 18,178.1 |

| BC-2402C | 2187 | 2507 | 320 | 214.0 | 3,968.4 | 17,175.0 |

| Table 4 Rubidium Composites | ||||||

| From (ft) | To(ft) | Interval (ft) | Rb (ppm) | Li (ppm) | B (ppm) | |

| BC-2301C | 1960 | 2360 | 400 | 276.9 | 4,116.0 | 15,840.0 |

| BC-2303C | 2120 | 2480 | 360 | 284.2 | 4,688.3 | 16,441.1 |

| BC-2401C | 2367 | 2665.5 | 298.5 | 313.2 | 5,444.2 | 18,320.1 |

| BC-2402C | 2127 | 2447 | 320 | 293.6 | 4,285.3 | 17,625.0 |

Correlation with Lithium and Boron

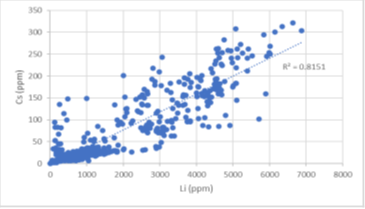

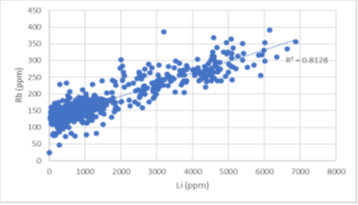

The Company has also reviewed the relationship of cesium and rubidium with lithium and boron. Scatterplots of assays for the same four holes (BC-2301C, BC-2303C, BC-2401C & BC-2402C) have been created and are displayed below. Cesium and rubidium grades display a good correlation with lithium, with an R2 a little over 0.81.

Such a correlation between lithium, cesium and rubidium and has been identified in illite-bearing samples at the Thacker Pass deposit, as referenced in the work of Benson et. al, (2023)*.

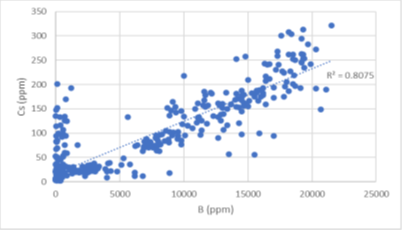

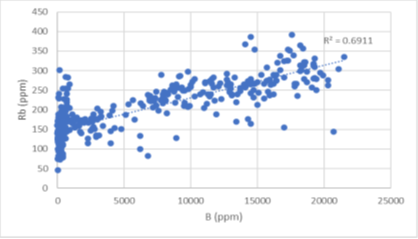

Cesium and rubidium grades also display positive correlation with boron grades, with an R2 just under 0.8 and 0.69 respectively. The correlation is affected by a low B population (<500ppm B) subset that shows no correlation.

Figure 1 Scatterplot of Cesium (ppm) Against Lithium (ppm) from BC-2301C, BC-2303C, BC-2401C & BC-2402C

Figure 2 Scatterplot of Rubidium (ppm) Against Lithium (ppm) from BC-2301C, BC-2303C, BC-2401C & BC-2402C

Figure 3 Scatterplot of Cesium (ppm) Against Boron (ppm) from BC-2301C, BC-2303C, BC-2401C & BC-2402C

Figure 4 Scatterplot of Rubidium (ppm) Against Boron (ppm) from BC-2301C, BC-2303C, BC-2401C & BC-2402C

* Benson, T, Coble, M & Dilles, J. (2023). Hydrothermal enrichment of lithium in intracaldera illite-bearing claystones, Science Advances 9, eadh8183, 10pp

About Nevada Lithium Resources Inc.

Nevada Lithium Resources Inc. is a mineral exploration and development company focused on shareholder value creation through its core asset, the Bonnie Claire Lithium Project, located in Nye County, Nevada, where it holds a 100% interest. The Company completed a Preliminary Economic Assessment (PEA) in August 2025. The PEA concluded that Bonnie Claire could produce more than 62,300 tonnes of lithium carbonate and 129,500 tonnes of boric acid annually, over a 61-year mine life.

Bonnie Claire’s investment metrics show a 32.3% IRR, a capital payback of 2.8 years, and a capital intensity of $34,080/tonne lithium carbonate. A $1,973/tonne boric acid by-product credit generates a $6,777/tonne lithium carbonate operating cost. The 18,300 acre property has not been fully explored, and the trend of high-grade lithium and boron mineralization remains open in three directions.

For further information on Nevada Lithium and to subscribe for updates about Nevada Lithium, please visit its website at: https://nevadalithium.com/

QP Disclosure

The technical information in the above disclosure has been reviewed and approved by the designated Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), Dr. Jeff Wilson, PhD, FGC, P.Geo, Vice President of Exploration for Nevada Lithium and is not independent of the Company as defined by Section 1.5 of NI 43-101.

On behalf of the Board of Directors of Nevada Lithium Resources Inc.

“Stephen Rentschler”

Stephen Rentschler, CEO

For further information, please contact:

Nevada Lithium Resources Inc.

Stephen Rentschler

CEO and Director

Phone: (647) 254-9795

E-mail: sr@nevadalithium.com

Media Inquiries

E-mail: info@nevadalithium.com

Find Nevada Lithium on Twitter and LinkedIn

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this news release. TSX Venture Exchange has not approved or disapproved of the contents of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities legislation. Forward-looking statements in this release include, but are not limited to, projections regarding the Bonnie Claire Lithium Project’s ability to generate revenue from lithium and boron, the potential recovery of cesium and rubidium, anticipated engagement with U.S. government funding programs, the possible benefits of the One Big Beautiful Bill Act of 2025, and assumptions about future production rates, mine life, resource expansion, pricing, and profitability. These statements also include expectations regarding the evaluation and recoverability of additional critical minerals, future plans, and economic performance of the Company and its Bonnie Claire Project.

Forward-looking statements are based on the Company’s current expectations, estimates, and assumptions, which are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, risks related to regulatory approvals, changes in market conditions, fluctuations in commodity prices, operational risks, uncertainties in resource estimates, and other risk factors described in the Company’s public disclosure filed on SEDAR+.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Images accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4bc95790-4d83-4a5f-8cd9-6b0cc31c5c2f

https://www.globenewswire.com/NewsRoom/AttachmentNg/594bbd38-7fdd-4469-9ec6-4b4e5f37a061

https://www.globenewswire.com/NewsRoom/AttachmentNg/0e603838-a184-4ce2-8da5-d4d8e04fc650

https://www.globenewswire.com/NewsRoom/AttachmentNg/863ce246-849b-4ac8-b419-30c254c0c933

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. USA Newshour takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. USA Newshour takes no editorial responsibility for the same.