AI in Insurance Market Projected to Reach USD 59.50 Billion by 2033 with Rapid 27.32% CAGR | SNS Insider

The AI in Insurance market is expanding rapidly as insurers adopt AI-powered software and services—including machine learning, NLP, and RPA—to enhance underwriting, claims, fraud detection, and customer experience, driven by digitalization and demand for efficient risk management.

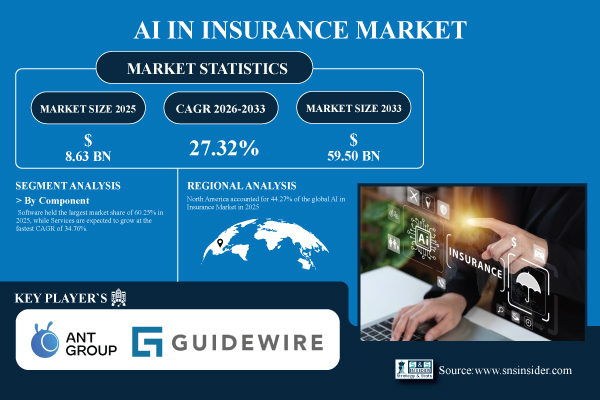

Austin, Oct. 10, 2025 (GLOBE NEWSWIRE) — The AI in Insurance Market size was valued at USD 8.63 billion in 2025E and is projected to reach USD 59.50 billion by 2033, growing at a CAGR of 27.32% during 2026–2033.

Advertisement

The U.S. AI in Insurance Market was valued at USD 3.15 billion in 2025 and is projected to reach USD 21.23 billion by 2033, growing at a robust CAGR of 26.95% during 2026–2033. This rapid growth is driven by the increasing adoption of AI technologies across insurance operations, including claims processing, fraud detection, customer service, and risk management, as insurers seek to enhance efficiency, reduce operational costs, and improve customer experience.

Download PDF Sample of AI in Insurance Market @ https://www.snsinsider.com/sample-request/8550

Key Players:

- Ant Group

- Guidewire Software

- DXC Technology

- Shift Technology

- Quantiphi

- Cape Analytics

- Zesty.ai

- Mind Foundry

- EXL Service

- Policybazaar

- Clearcover

- Lemonade

- Sixfold

- DataRobot

- LeewayHertz

- ZBrain

- Markovate

- AI Insurance Solutions Inc.

- Quantitative Risk Management (QRM)

- Counterforce Health

AI in Insurance Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 8.63 Billion |

| Market Size by 2033 | USD 59.50 Billion |

| CAGR | CAGR of 27.32% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Technology (Machine Learning, Natural Language Processing, Robotic Process Automation, Computer Vision, Others) • By Application (Fraud Detection & Risk Management, Customer Service & Chatbots, Underwriting & Claims Processing, Predictive Analytics, Others) • By Insurance Type (Life Insurance, Health Insurance, Property & Casualty Insurance, Reinsurance, Others) • By Deployment Mode (Cloud, On-Premise) • By End User (Insurance Companies, Brokers & Agents, Third-Party Service Providers, Others) • By Distribution Channel (Direct Sales, Online Platforms, Partners & Resellers, Others) |

| Customization Scope | Available upon request |

| Pricing | Available upon request |

If You Need Any Customization on AI in Insurance Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/8550

Segmentation Analysis:

By Component, Software Held the Largest Market Share of 60.25% in 2025, while Services are Expected to Grow at the Fastest CAGR of 34.76%

The Software segment held the largest market share of 60.25% in 2025, primarily driven by insurers’ demand for advanced analytics platforms, machine learning models, and AI-enabled policy management systems. The Services segment is growing rapidly due to increasing outsourcing of AI implementation, integration, and maintenance services, particularly for insurers lacking in-house AI expertise.

By Technology, Machine Learning Held the Largest Market Share of 44.78% in 2025, while Natural Language Processing (NLP) is Forecasted to Expand at the Fastest CAGR of 34.88%

Machine Learning (ML) leads the market with the largest share, driven by its ability to detect patterns in large datasets, predict customer behavior, and optimize underwriting and claims processing. Meanwhile, Natural Language Processing (NLP) is projected to grow at the fastest CAGR as insurers increasingly deploy AI-powered chatbots, virtual assistants, and document processing solutions to improve customer engagement and operational efficiency.

By Application, Fraud Detection & Risk Management Held the Largest Share of 35.46% in 2025, while Customer Service & Chatbots are Expected to Grow at the Fastest CAGR of 34.92%

Fraud Detection & Risk Management dominates the application segment, fueled by the rising incidence of insurance fraud and the need for real-time, AI-driven anomaly detection. In contrast, Customer Service & Chatbots are growing fastest as insurers focus on enhancing customer experience, providing 24/7 support, and reducing operational costs via conversational AI platforms.

By Insurance Type, Property & Casualty Insurance Held the Largest Share of 40.67% in 2025, while Health Insurance is Anticipated to Grow at the Fastest CAGR of 34.81%

Property & Casualty (P&C) Insurance leads due to its higher claim volumes and operational complexity, which benefit significantly from AI-powered automation, risk assessment, and claims verification. Health Insurance is experiencing the fastest growth as providers leverage AI for claims processing, personalized health management, and fraud detection in a rapidly digitizing healthcare ecosystem.

By Deployment Mode, Cloud-Based Solutions Accounted for the Dominant Market Share of 50.33% in 2025, while On-Premise is Expected to Grow at the Fastest CAGR of 34.79%

Cloud-Based solutions, with a 50.33% market share, are driven by their scalability, cost efficiency, and ability to enable collaborative AI workflows across multiple branches and stakeholders. On-Premise deployment is growing rapidly due to insurers’ focus on data privacy, regulatory compliance, and control over sensitive policyholder information.

By End-User, Insurance Companies Dominated with a Share of 69.84% in 2025, while Third-Party Service Providers are Expected to Grow with Fastest CAGR of 34.85%

Insurance Companies holds a dominant share in 2025, are adopting AI to enhance operational efficiency, improve underwriting accuracy, and reduce costs. Third-Party Service Providers are growing fast by offering specialized AI solutions, platform integration, and managed services to smaller insurers and startups, helping them overcome technology adoption barriers.

By Distribution Channel, Direct Sales Contributed the Dominant Market Share of 59.72% in 2025, while Online Platforms are Expected to Grow at the Fastest CAGR of 34.91%

Direct Sales dominates the market due to established sales networks and traditional insurance models, where insurers control customer interactions. Online Platforms are growing at a faster rate as digital distribution becomes critical, driven by increasing consumer preference for self-service portals, online policy purchases, and AI-driven customer engagement tools.

Regional Insights:

North America accounted for 44.27% of the global AI in Insurance Market in 2025, with over 5,100 AI implementations across underwriting, claims, and fraud detection. Early adoption of innovative analytics, predictive modeling and AI-enabled customer engagement is propelling the region.

The Asia Pacific AI in Insurance Market is projected to grow at a CAGR of 28.68% during 2026–2033. In 2025, at least 3,150 AI implementations were reported in China, Japan, India, and Australia with a focus on underwriting and claims automation as well as customer engagement.

Recent Developments:

- In September 2025, Ant Group launched “Yixiaobao,” an AI-powered insurance advisor offering policy guidance, product comparisons, and claims assistance.

- In May 2025, Guidewire launched IndustryIntel, an AI solution automating underwriting and claims document handling.

Buy Full Research Report on AI in Insurance Market 2026-2033 @ https://www.snsinsider.com/checkout/8550

Exclusive Sections of the Report (The USPs):

- ADOPTION & IMPLEMENTATION METRICS – helps you track the global deployment of AI-driven insurance processes, including claims, underwriting, and fraud detection, along with the number of insurers and startups leveraging AI solutions.

- TECHNOLOGY USAGE INDEX – helps you understand the utilization of AI technologies such as Machine Learning, NLP, RPA, and Computer Vision, including the number of predictive analytics programs and technology-specific AI projects.

- APPLICATION-SPECIFIC ADOPTION – helps you assess the deployment of AI in key insurance functions, including Fraud Detection & Risk Management, customer service chatbots, and underwriting or claims automation initiatives.

- DEPLOYMENT & PLATFORM METRICS – helps you evaluate the adoption trends between Cloud-based and On-Premise AI solutions, the use of SaaS platforms, and regional variations in deployment strategies.

- EFFICIENCY & AUTOMATION IMPACT – helps you gauge improvements in operational efficiency, such as AI-powered policy automation, claims processed annually, and reduction in manual intervention across insurance workflows.

- INNOVATION & MARKET PENETRATION – helps you uncover opportunities for investment and collaboration by monitoring the number of AI startups and new AI initiatives in insurance, highlighting underpenetrated regions and technology segments.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. USA Newshour takes no editorial responsibility for the same.

Disclaimer: The above press release comes to you under an arrangement with GlobeNewswire. USA Newshour takes no editorial responsibility for the same.