Biden’s Tax proposal and capital gains at death in conflict

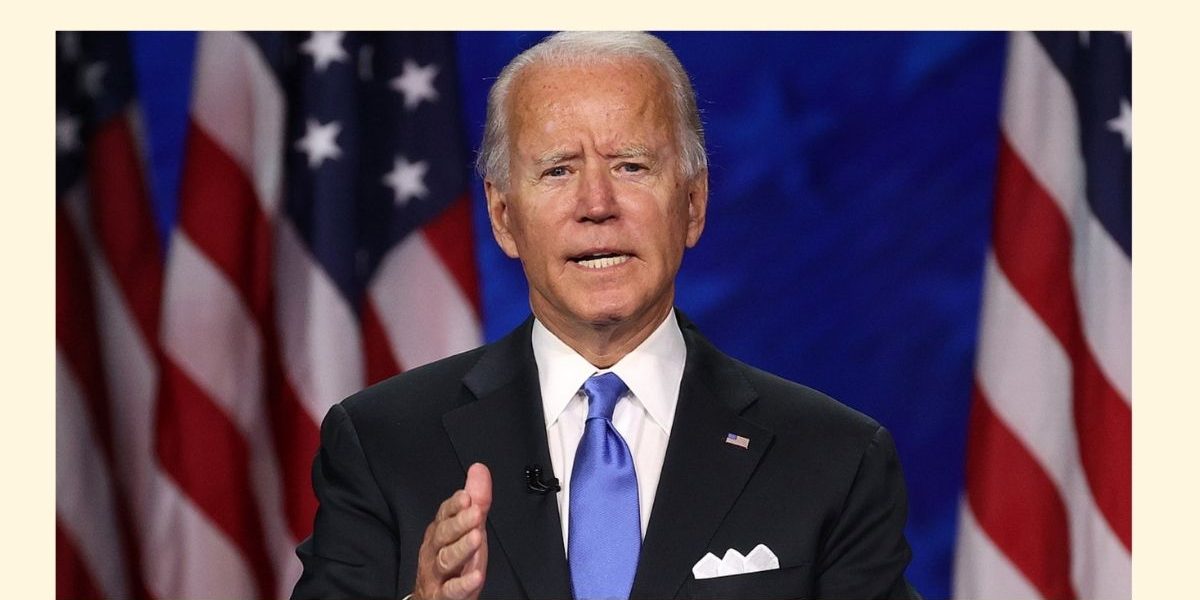

President Biden seems strong on keeping his campaign promise regarding tax raises for only the country’s richest 2%. Any decedent who fell under the category of the rest of the 98% before demise may face the tax raise, but the problem here is that a certain fraction of people will face higher taxes at death.

It has been explained in President Biden’s Taxes on Wealthy Estates. According to The Tax Foundation- “The American Families Plan would tax unrealized capital gains at death for unrealized capital gains worth over $1 million. Currently, long-term capital gains of high earners are subject to a 20 percent tax rate and the 3.8 percent net investment income tax (NIIT) when the gains are realized (sold).”